Click LIKE to Follow us at Facebook

HarmonicForex Point System that helps you to pick the right trade when in confusion. The system gives every harmonic trade a score of 5 to 10.

The criteria is:

5-6 -> Skip the trade

7-8-> Exercise caution

9-10-> Take the trade

==============================================

Synopsis of the Talk on 22-May-13 OnlineTradersClub.ORG at #29-03 International Plaza

- To know more about the harmonic way of trading Forex

-

As fancy as it sounds, it is a great system which places great emphasis

on risk management, risk to reward ratio and most importantly a healthy

lifestyle.

- Listen with an open mind and you can learn something

- FAQ

http://harmonicforex.com

http://twitter.com/harmonicfx

www.facebook.com/groups/fxgump

www.facebook.com/pages/harmonicforex

Terry Tan is the founder and director of HarmonicForex.com

He has been trading the Forex market since 2009 and has written countless articles on trading the market the right way

He adopts a swing trading strategy based on harmonic patterns and is a big fan of the PRZ (Potential Reversal Zone)

He is OCBC stock broker by day and forex trader at night.

Introduction to HarmonicForex

Formerly FxGump, a Singapore FX portal started in 2011

Name changed in 2012 when we decided that harmonic trading is the way going forward for us

Started by 4 dudes who are doing it for passion while holding on to a full time job

Milestones & Achievements

2011 - had a total of 6 private students

2012 Jan - Rebranded into HarmonicForex.com

2012 May - Started FB sharing group

2012 Aug - Hit 1000 followers on twitter and site registrants

2013 Jan - Speak at FXTrading@SG

2013 Feb - Conducted first mass seminar HFU intake 1 with 8 students

2013 Apr - First introduction to HFX seminar

2013 May - FB sharing group reaches 400 followers

2013 May - Speak at Harmonics at OTC Singapore

The Birth of Harmonic Trading

We are not the creators of Harmonic Trading

Scott Carney is widely known as the original creator of harmonic trading.

Jason Stapleton of T2U is also one of the guys we learn from before we come out with our own Harmonics plus system which includes a minor tweak to the original Harmonic pattern trading system.

This system is 80% based on the original harmonic trading syllabus with a slight 20% tweak which we will share with our readers in time to come.

Harmonic Trading by Jason Stapleton Vol 1 & 2 - published 2010

The Harmonic Trader by Scott Carney published 1999

Why Harmonics

Maximize reward to risk ratio

- Classic double top vs

- Trend line break vs

- Harmonic Entry

Clear entry PRZ and exit points TP1-3

Clear rules to trade removes emotion

Our second favourite reason:

- Pattern in advanced

- Set and forget

It really picks turning points accurately

What do we do at HFX?

Trade all 25 pairs (majors, crosses and exotic pairs)

Based mainly on H1, H4 and D1 time frame

3 favourite Harmonic patterns - Gartley, Bat and Cypher

Plan our trades way in advance before it happens

Adopt the set and forget trading mentality

Sharing trade ideas on the website and facebook group

Harmonic Summary

Good Entry Levels & Great Risk Reward

Identify patterns and set trades in advance, before it happens

With the trend, counter trend, ranging

Happens on D1, H4 and H1

Also M15 and M5 (not preferred)

Patterns within pattern

Reliable & Consistent

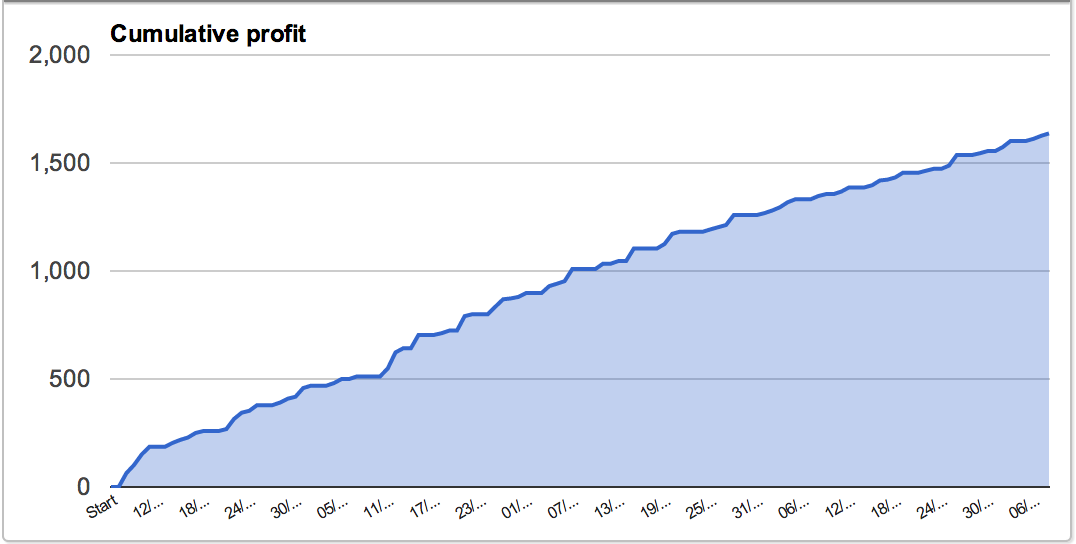

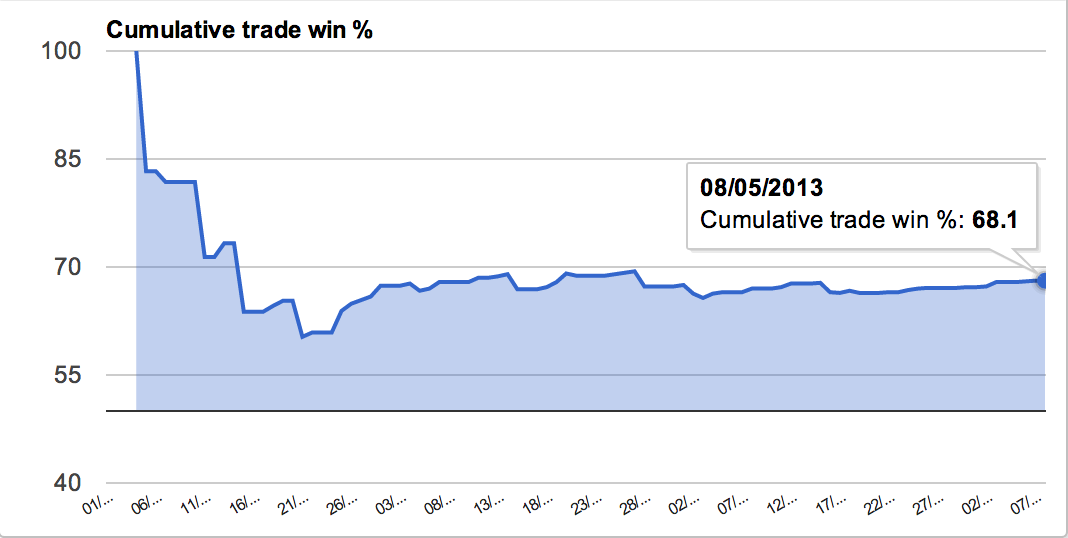

Amazing Results - well documented

Harmonic Plus Course Outline

- Fibonacci

- RSI

- Psychology

- 3 patterns

- Harmonic Plus Trading System

- Risk Management

HarmonicForex University Intake 3 @ 27July2013 - S$2,000

1 Full day plus 3 live trading sessions

Today offer $1,700 at 15% discount

With 3 OTCS members sign up further $100 discount each and 5 OTCS members $200 discount.

===================================================

How to Avoid Failed (Invalidated) Harmonic Pattern

The Harmonic Pattern is so popular and we all agree it really works !! Many of Harmonic Trading topics are full of succesful screenshots of Patterns like Gartley, Butterfly, Bat ...etc. What about the opposite, the invalidated (also called failed) ones ?

In fact, Harmonic Pattern success rate is only about 80%.

I'll start posting some of failed cases and then I will show how to avoid it. Following examples present invalidated/failed patterns:

|

| This is an emerging Bullish Gartley Pattern, deteced by one Harmonic Pattern Indicator, price was supposed to go up after the pattern is displayed... . what really happened afterward is price continuing down and the Harmonic Pattern expand it's right wing and failed eventually |

Here are more definitely failed pattern:

|

| The pattern signal a short sell but price still go up |

|

| Bullish Butterfly doesn't work !!! |

That's why we have developed an extra confirmation oscillator to increase the successful ration of the pattern, it will filter out failed pattern and also reduce the number of potential trades. But as veteran traders Sive Morten has taught: "...Trader should better accept losing trading chance than losing trading capital..", I am happy to introduce it to you Super Trend Oscillator.

Come back to the very first screenshot in this post and compare the entry signal with the screenshot below, you will see how it pick the perfect bottom:

|

| Compare this screenshot with the very first chart in this post to see how good it generate Buy Signal |

Here is an overview of the whole system :

|

| All Signals are generated consistently with the Emerging Harmonic Patterns and help you confidently enter the trade without worrying it would fail |

Another successful case :

Here are our feedback of a recent Japanese Customer :

|

| Happy recent customer ! |