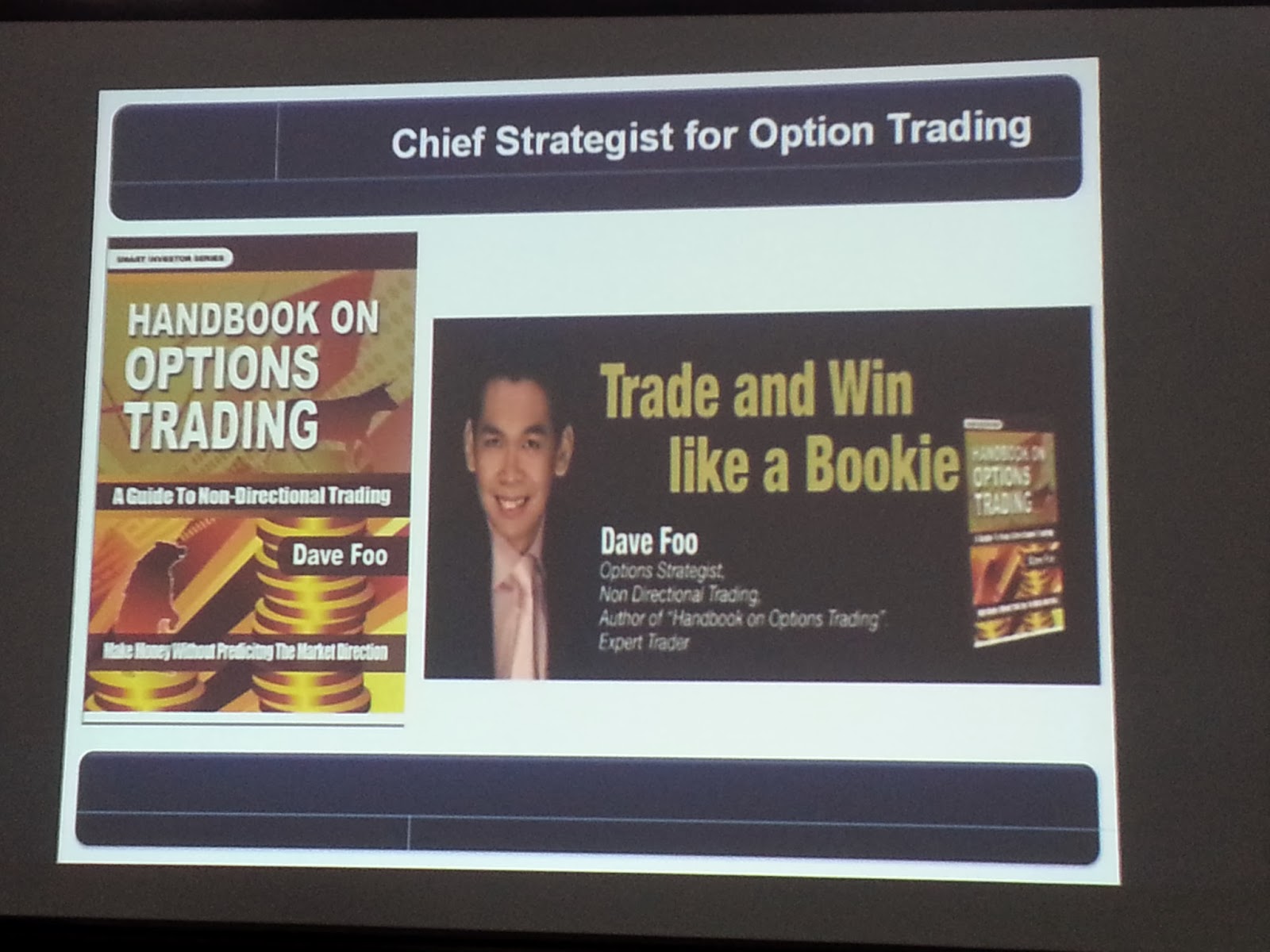

Dave Foo at TRT Open House on 4Jan2014

He uses ThinkorSwim his live account to illustrate his two live options position on ES (S&P) and NG (Natural Gas)

=================================================================

NDT (Non Directional Trading ) Preview by Dave Foo on 20 Nov 2012 TRT

Starter:

use 3 4D tickets to demonstrate Options

Contracts expiring worthless

Q&A:

minority 4 who answered never buy 4D in

life – given a free DVD worth $247

DVD Contents: Iron Condo and Double

Calendar on equity options

Soup of the day:

Trading concepts and stories telling

Trade records: 64% in 2.8years

Main Course:

Sell / Short Strangles to generate income,

and Adjustment

between high line and low line and allow

expiring worthless

Sell Put at lower strike at low probability

Sell Call at higher strike at low

probability

High probability to keep premium

Products 4 out of 7 Futures (CL, ES, ZB, ?,

ZC, ZW, ZS, no currency futures too volatile )

Day1: Options principles by Thomas Saw of

TRT

Day2: Main Course by Dave Foo

Night1-5: Night Live Trading Demonstrations

by Dave Foo

Night1-5: Students trade Demo account only

because of lacking adjustment knowledge.

Paycheck:

$2488 ( $2288 if skip Day1 )

==============================================================

===============================================================

Non-Directional Trading (NDT), Dave Foo Nov-2012

We are happy to announce our brand-new collaboration with Dave Foo of Delta-Neutral Trading.Dave will be presenting his long-running Delta-Neutral Trading (DNT) event, expanded from the previous 2.5-day course into a 3-month-long programme. The programme is meant for existing Options traders and trades Options on Futures.

You probably want to be keeping your eye on this: Dave's track record over the last 3 years (2010-2012) has been more than 300%!

Previews: 7.30-9.30 pm, Nov 20 and 27 2012

Dates: Theory - 10-5, Dec 8 and 9; Market - 8.30-12.30 pm, Dec 14 and 20; Jan 11 and 24 2013; Feb 21 2013

Cost: $2,488 (on Preview days); $2,688 (until 30 Nov); $2,888 (after 30 Nov)

Link: NDT Registration

============================================================

http://www.nondirectionaltrading.com Oct-2012

"Losing money becomes difficult if you know the rules of the Game"

Dave Foo

Option trading course - around S$2,500.

======================================================

http://www.NonDirectionalTrading.com/

Course Content

Day 1 - Basic (9am - 5pm) Saturday

Trading is a War Zone

Why Options Trading

Basic Introduction to the world of Options Trading - Call and Put

Options Greeks - Delta, Theta

Options Volatility - Is Options Volatility really that important?

Stocks Options vs Futures Options

Why Sell Options?

Why not Stocks Options?

Iron Condor - Non Directional Trading

Strategy 1 - Short Strangle - The strategy that make money 95% of the time

Which Strike to Choose? The How and the Why?

Probabilities trading

Rolling and adjusting your Strangle

Q&A

Day 2 - Advanced (9am - 5.00pm) Sunday

1st day recap follow by Q&A

Time Value and how to calculate how much Options is losing everyday

Strategy 2 - OPM Trade - Other People Money strategy

Which Strike to Choose? The How and the Why?

Probabilities trading

Rolling and adjusting your OPM

Defending your trade

Alert System

SPAN Margin / PC-SPAN

Q&A

Day 3 - Trading Demostration (7pm - 10pm) Monday

More rolling Technique

A Truly Non Directional Market (Strangle + OPM)

Money Management and Margin Control

Trading Demonstration (Education Purpose only) 7.00pm - 10.00pm

Come and see how 1,000's of individuals like YOU are working for a LIVING online and are fulfilling their wildest dreams TODAY.

ReplyDeleteCLICK HERE TO FIND OUT

QUANTUM BINARY SIGNALS

ReplyDeleteGet professional trading signals delivered to your cell phone every day.

Follow our signals NOW & make up to 270% per day.